charitable gift annuity example

Statement describing the material terms of. You should also be aware that the joint gift annuity.

Charitable Gift Annuity Wise Healthy Aging

A commercial insurance company is willing to issue an annuity on her life as if she only had 3.

. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to UC San Diego. Taxation of a charitable gift annuity. The minimum contribution to form a CGA is 25000 for individuals 60 years or older.

Is a charitable gift annuity right for you. Age Payment Rate Annuity Deduction. Sample Annuity Rates for Gift Amount of 25000.

A graphic illustration of a charitable gift annuity is available. Sample Annuity Rates for Gift Amount of 20000. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Give Gain With CMC. A charitable gift annuity. Ad Earn Lifetime Income Tax Savings.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12027 the amount of the 25000 donation. State tax liability is not.

In addition to these fixed annuity payments you receive a charitable tax-deduction in the year you make. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Definition and Example of a Charitable Remainder Annuity Trust.

This gift annuity shall be designated in a separate fund agreement signed by the Donors and the Foundation. Summary of Benefits for Alice Gift Annuity. Ad Earn Lifetime Income Tax Savings.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to KCU. Because they need continuing income they decide to give the cash in exchange for.

An example would be if you established a 100000 gift annuity at the age of 70. Fox example future income payments are subject to the ability of the. Annuities are often complex retirement investment products.

Charitable gift annuities as with all things have benefits and risks. If so you would receive 4700 annually. Simply input the amount of your possible gift the basis of the property and the.

7 rows Susan would like to provide her mother Esther 80 with additional income but knows that her. The minimum gift for setting up a charitable gift annuity may be as low as 5000 though it is usually much greater. Sample Deferred Gift Annuity Rates.

A charitable gift annuity. Jones is 87 years old and in poor health. Learn some startling facts.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Charitable Gift Annuities An Example. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity.

Give Gain With CMC. An example of a Charitable Gift Annuity for an individual annuitant. Because they need continuing income they decide to give the.

Age Payment Rate Annuity Deduction. As with any other. 7 rows For example if you created a 100000 gift annuity at age 70 you could expect to receive.

A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets. Check with our representative for current rates and applicable ages for deferred charitable gift annuity eligibility according to our most current policies. Gift annuities are easy to set up and the payments you.

Example assumes a 34 percent applicable federal rate AFR and a federal income tax bracket of 35. A charitable gift annuity provides fixed payments for life in exchange for a gift of cash or securities to Columbia University. The annuitant may also be eligible for a tax deduction based.

This type of trust is a financial. Alice age 70 agrees to a gift of 20000 to Unbound in return for life income. You will incur no costs to establish the arrangement and no.

A charitable remainder annuity trust CRAT is an option for estate planning. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Charitable Gift Annuities An Example.

A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement. Charitable Gift Annuity.

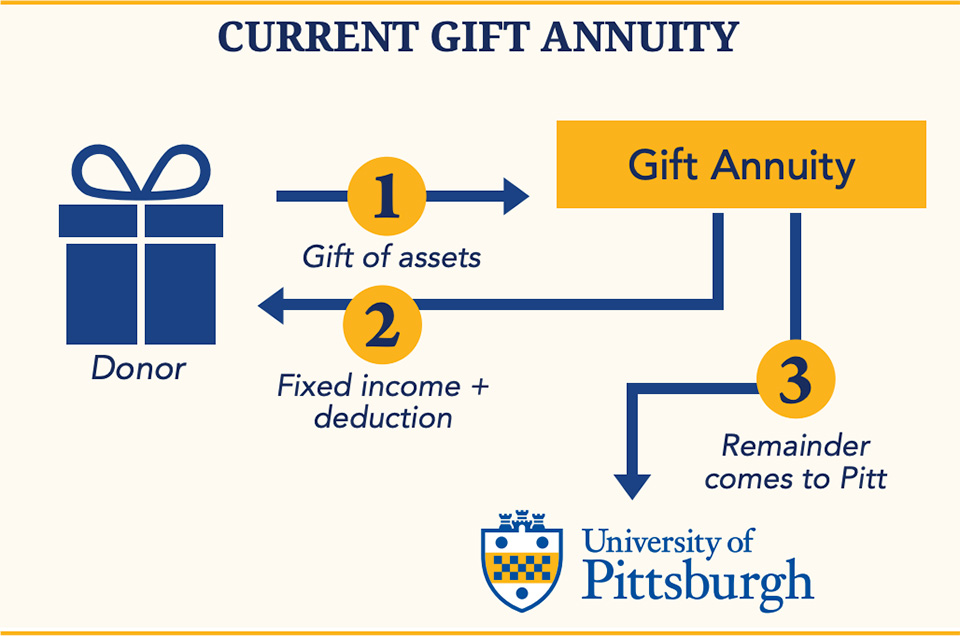

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuity Texas A M Foundation

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Immediate Payment Gift Annuity Mount Holyoke College

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

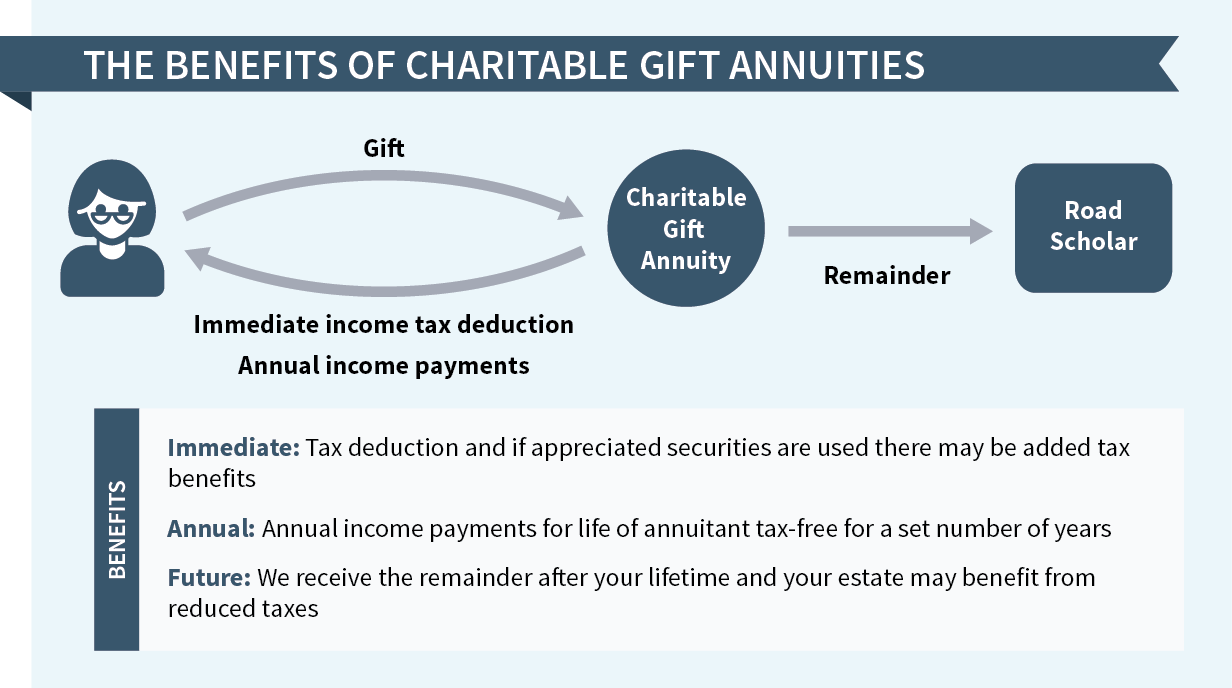

Charitable Gift Annuities Road Scholar

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Charitable Gift Annuities Development Alumni Relations

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

Tools Techniques 101 The Charitable Gift Annuity Withum

Charitable Gift Annuities Giving To Stanford

Pin On Higher Ed Marcomm Ideas

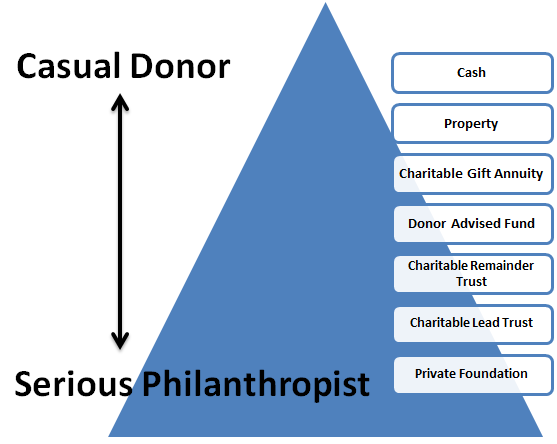

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Found On Bing From Ovdf Org Brochure Examples How To Plan Brochure